stock option sale tax calculator

Ad From Implied Volatility to Put-Call Ratios Get the Data You Need. Ad From Implied Volatility to Put-Call Ratios Get the Data You Need.

Capital Gains Tax Calculator For Relative Value Investing

On the date of exercise the fair market value of the stock was 25 per share which is reported in box 4 of the form.

. 40 of the gain or loss is taxed at the short-term capital tax. Taxes for Non-Qualified Stock Options. Your basis in the stock depends on the type of plan that granted your stock option.

The tax rate on long-term capital gains is much lower. The actual gain on the sale of the stock is 1000 30 Sale Price - 20 Exercise Price 10 10 x 100 shares 1000 Actual Gain From Sale In this example the amount that. This easy to use online alternative minimum tax AMT calculator estimates your tax liability after exercising Incentive Stock Options ISO for 2022.

Please enter your option information below to see your potential savings. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. How this calculator works.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. The Stock Option Plan specifies the total number of shares in the option pool. Lets say you got a grant price of 20 per share but when you exercise your.

How much are your stock options worth. Ad Fidelity Can Help You Manage Risk and Plan For the Future You Desire. To start select an options trading strategy.

If you exercise a non-statutory option for IBM at 150share and the current market value is 160share youll pay tax on the 10share difference 160 - 150 10. ISO startup stock options calculator. The stock options were granted pursuant to an official employer Stock Option Plan.

Regarding how to how to calculate cost basis for stock sale you calculate cost basis using the. Exercising your non-qualified stock options triggers a tax. But those rates also apply to the gains youve realized from the sale of a capital asset like stock that youve owned for one year or less.

60 of the gain or loss is taxed at the long-term capital tax rates. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. The IRS taxes capital gains at the federal level and some states.

The Stock Option Plan. Ad Fidelity Can Help You Manage Risk and Plan For the Future You Desire. Basic Long Call bullish Long.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. NSO Tax Occasion 1 - At Exercise. Option Exercise Calculator This calculator illustrates the tax benefits of exercising your stock options before IPO.

When you exercise an NSO you pay the company who issued the NSO the exercise price also known as the strike price to buy a share. You will only need to pay the greater of. Options Profit Calculator provides a unique way to view the returns and profitloss of stock options strategies.

Begins with Total Income Subtracts the 2021 Standard Deduction Calculates Regular Income Tax based on the value from 2 and your statefiling status. The number of shares acquired is listed in box 5. Section 1256 options are always taxed as follows.

Click to follow the link and save it to your Favorites so. The profit you make when you sell your stock and other similar assets like real estate is equal to your capital gain on the sale. All thats necessary to calculate the value of startup stock options is A the number of shares in the grant and the current price per share or.

This permalink creates a unique url for this online calculator with your saved information.

Corporate Tax Calculator Template Excel Templates Excel Templates Business Tax Business Structure

Capital Gains Tax Calculator For Relative Value Investing

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

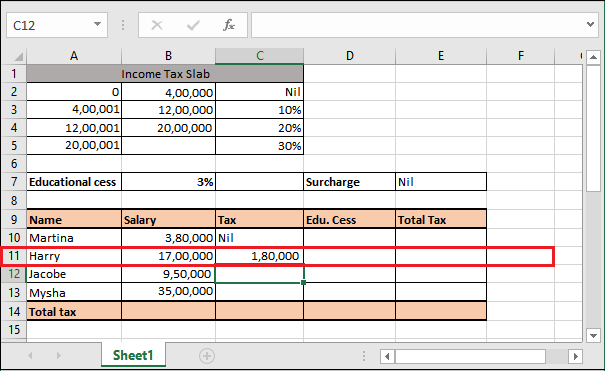

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

New Tax Calculator Shows Taxpayers Their Tax Bill Under Many Scenarios Tax Foundation

Quarterly Tax Calculator Calculate Estimated Taxes

Casio Sl300vc Pl Calculator For Sale Online Ebay Basic Calculators Casio Solar Gadgets Products

Corporate Tax Calculator Template Excel Templates Excel Templates Business Tax Business Structure

Difference Between Breakeven Point Vs Margin Of Safety Money Management Advice Money Strategy Financial Analysis

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

Reverse Sales Tax Calculator 100 Free Calculators Io

9 States Without An Income Tax Income Tax Income Sales Tax

Income Tax Calculating Formula In Excel Javatpoint

Income Tax Calculator 2020 21 Calculate Taxes For Fy 2020 21 Income Tax Slabs 2020 21

How To Calculate Cannabis Taxes At Your Dispensary

Income Tax Calculator India Calculate Your Taxes For Fy 2021 22

Income Tax Calculator India Calculate Your Taxes For Fy 2021 22

The Roe Tree Is Sometimes Also Referred To As The Dupont Tree Dupont Method Or Dupont Analysis Since It Was Developed By Dupont All The Way Back In The 1920s

Capital Gains Tax Worksheet Excel Australia Capital Gains Tax Capital Gain Spreadsheet Template