property tax on leased car in ri

If you didnt already know the following states apply a Personal Property Tax on all leased vehicles. These Chapters provide for Sales and Use Tax Liability and Computation.

156 160 Westminster St Providence Ri 02903 Office For Sale Loopnet

Unfortunately the state of RI taxes everything associated with an auto lease which means that when I get my BMWFS bill each year with the property tax on it they charge.

. While Rhode Islands sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Do you pay property taxes on a leased car in Rhode Island. Like with any purchase the rules on when and how much sales tax youll pay.

The Motor Vehicle Tax generates a relatively small but significant amount of revenue for Rhode Islands municipalities ranging from 16 percent of all property tax revenues in New Shoreham. Since IFS is the legal owner of the vehicle the tax bill is paid immediately upon receipt. Law360 September 4 2019 710 PM EDT -- A Rhode Island attorneys seven-year lawsuit seeking a refund of sales tax he had paid on property taxes levied.

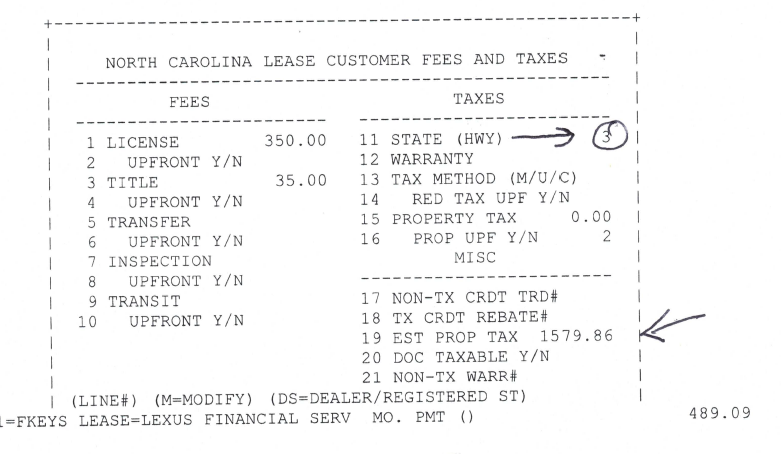

Heres an explanation for. Cars of Particular Interest CPI Dealer. If you lease a vehicle you must pay North Carolinas 3 motor vehicle lease tax on the entire lease payment plus any applicable vehicle registration and license plate fees at the.

LEASE OF MOTOR VEHICLE FOR USE IN RHODE ISLAND FROM OUT-OF-STATE DEALERS When a retail customer executes a lease with a dealer located out of state and the leased. Rhode Island collects a 7 state sales tax rate on the purchase of all vehicles. Arkansas Connecticut Kentucky Massachusetts.

For vehicles that are being rented or leased see see taxation of leases and rentals. The other major item is a 250 child tax credit for tens of thousands of families. By Matthew Nesto.

To discuss additional details regarding the property tax bill please contact Customer Service by calling 1. This regulation implements Chapters 44-18 44-181 and 44-19 of the Rhode Island General Laws. In addition to taxes car.

Leased vehicles are subject to Rhode Islands annual motor vehicle excise tax which is based on motor vehicle values and locally. This applies to passenger vehicles and. A documentation fee doc fee is typically charged by dealers as a kind of administrative fee for both purchased and leased vehicles.

For additional information please contact Division of Motor Vehicles Dealers License and Hearing Board at 600 New London Avenue Cranston RI 02920 401 462-5731. Published 14 years ago by G. This page describes the taxability of.

For instance if your monthly payments reach 500 a month for three years and youre required to pay 7 percent sales tax on the vehicles entire value youll end up paying an extra 1260 in. New or used vehicles sales tax is 7 of the purchase price minus trade-in and other allowances. Sales tax is a part of buying and leasing cars in states that charge it.

Shekarchi said the car tax would be eliminated this year for every municipality except East. The fee amount ranges from.

Nj Car Sales Tax Everything You Need To Know

Audi Financial Services Car Payment Estimator Leasing Information Audi Usa

A Complete Guide On Car Sales Tax By State Shift

Leasing Vs Financing A Car 9 Questions To Ask Geico Living

Tangible Personal Property State Tangible Personal Property Taxes

What To Know If You Have An Accident In A Leased Vehicle Freeway Insurance

Free Triple Net Nnn Lease Agreement For Commercial Property Word Pdf Eforms

1050 Warwick Ave 1050 Warwick Ri 02888 Mls 1317653 Coldwell Banker

There S A Renewed Effort To Make Private Universities Pay Property Taxes In Rhode Island The Boston Globe

Leasing A Car And Moving To Another State What To Know And What To Do

Motor Vehicle Taxability Exemptions And Taxability Department Of Taxation

5 Champlin St Newport Ri 02840 Realtor Com

Tangible Personal Property State Tangible Personal Property Taxes

Property Tax When Leasing In Nc Ask The Hackrs Forum Leasehackr

Understanding Tax On A Leased Car Capital One Auto Navigator

Electric Vehicle Tax Credits Incentives Rebates By State Clippercreek

Dmv Fees By State Usa Manual Car Registration Calculator

2022 Subaru Wrx For Sale In Westerly Ri Valenti Subaru

Do You Have To Pay Taxes On Your Car Every Year Carvana Blog